Alternative Calculation

Just like what I said in previous, we can rid of the guard.

Using List and Maximum

List come to the rescue.

-- taxable incomes

pkps :: [Int]

pkps = [50*10^6, 250*10^6, 500*10^6, 10^9]

-- income tax using progressive tariff

pph :: Int -> Int

pph pkp = maximum $ [round(x) | x <- pph_list]

where

-- Typecast, such as to Double

pkp_d = fromIntegral(pkp)

-- to avoid typo in writing digit

million = 10^6

-- tariff rate in percent

pph_p = [0.05, 0.15, 0.25, 0.30]

-- difference, short version

pph_d = [0, 5, 30, 55]

-- difference, in million rupiah

pph_dj = map (fromIntegral <$> (*million)) pph_d

-- range list, zero based index

level = [0, 1, 2, 3]

-- main calculation, calulate all level

pph_list = [pkp_d * (pph_p !! x) - (pph_dj !! x) | x <- level]

main = print $ map pph pkpsCode above will have the result as below

2500000

32500000

95000000

245000000The downside of the method in code above is,

all four ranges calculated first before finding the maximum value.

It does not looks efficient.

Can the code be shorter ?

Dictionary

We can compress the list further into dictionary.

-- [(percentage, difference)]

tariffSchema :: [(Double, Int)]

tariffSchema =

[(0.05, 0)

,(0.15, 5)

,(0.25, 30)

,(0.30, 55)

]First and Second

And access the value using,

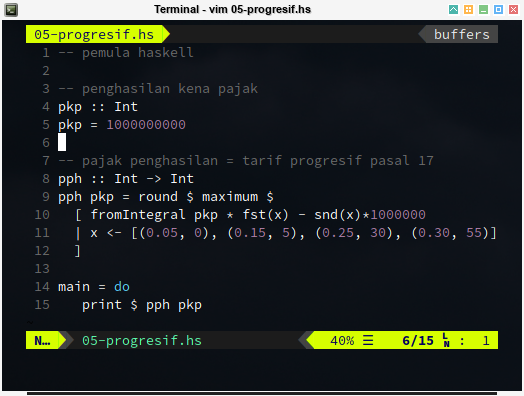

fst (first) and snd (second) as below code

[ fromIntegral pkp * fst(x) - snd(x) * (1000000)

| x <- [(0.05, 0), (0.15, 5), (0.25, 30), (0.30, 55)]

]Simply List

Or even simpler, just a list.

-- taxable incomes

pkps :: [Int]

pkps = [50*10^6, 250*10^6, 500*10^6, 10^9]

-- income tax using progressive tariff

pph :: Int -> Int

pph pkp = round $ maximum $

[ fromIntegral pkp * a - b * (10^6)

| (a, b) <- [(0.05, 0), (0.15, 5), (0.25, 30), (0.30, 55)]

]

main = mapM_ (print . pph) pkpsCode above will also result some lines for as below

2500000

32500000

95000000

245000000

The final code doesn’t feel as clear as our first post. And also it is not efficient as it has to calculate all four ranges.

List Comprehensions

The issue with maximum can be solved.

With last I found the right range,

and calculate only what I need.

import Data.Foldable

-- taxable incomes

pkps :: [Int]

pkps = [50*10^6, 250*10^6, 500*10^6, 10^9]

-- income tax using progressive tariff

pph :: Int -> Int

pph pkp = round $

(\(t, p, d) -> fromIntegral pkp * p - d * (10^6))

(reff !! last indices)

where

-- [(level, percentage, diff)]

reff = [(0, 0.05, 0), (50, 0.15, 5), (250, 0.25, 30), (500, 0.30, 55)]

indices = [ i | (i, (t, p, d)) <- zip [0..] reff, pkp >= (t * 10^6) ]

main = forM_ pkps (print . pph)Notice that I also import the Data.Foldable,

so that we can have for loop like syntax.

import Data.Foldable

...

main = forM_ pkps (print . pph)Code above will display the result line by line for each calculatin, as shown in below output:

2500000

32500000

95000000

245000000This code looks so cryptic. And it also longer than the previous one.

I guess I fail miserably.

What is Next ?

What do you think, the coolest code, between this four article?

We can go back to original calculation code from the first article, and let’s see if we can make simplified the code. Consider continue reading [ Haskell - Tax Tariff - Part Four ].

Thank you for visiting.